Why the US is Attracting Global Foreign Investment?

The Q1 2023 AFIRE, https://www.afire.org, - The Association of Foreign Investors’ International Investor Survey stated that foreign investors continue to be bullish on the US commercial real estate market. Investors are attracted to the US's solid economic fundamentals, political stability, US court-mandated property rights, property appreciation, attractive lower-risk returns, and liquid market.

- The US remains a preferred global destination for commercial real estate investment, with allocations up 6% from 2022.

- Multifamily and industrial are the most attractive property types for foreign investors.

- New York regained the top US spot, with the sunbelt states following for investment in 2023.

- London remains the top global city for planned investment in 2023.

-

- Institutional investors continue to see the US as a preferred destination relative to Europe for real estate investment across property types.

- Investors are optimistic about the US economy and the outlook for commercial real estate.

- Investors are focused on acquiring high-quality assets in attractive markets.

-

-

- Investors are increasingly focused on ESG investing principles.

- Investors seek opportunities to invest in affordable housing and other impact projects.

- Investors are using technology to improve their investment process and decision-making.

-

-

-

-

- Multifamily (94%)

- Industrial (94%)

- Hospitality (61%)

- Office (47%)

- Retail (41%)

-

-

- The US economy is one of the world's largest and most diversified economies.

- The US unemployment rate is low, and wages are rising.

- The US consumer is strong, and spending is robust.

- The US has a Pro-growth Agenda- a solid legal and regulatory framework projecting a favorable Foreign investment climate.

- Exchange rate fluctuations can create opportunities for investors to capitalize on favorable currency rates due to the strength of the US Dollar compared to the Investor's home currency/ upon the return of capital funds to the Investor's home country.

- Commercial real estate in the US has historically generated attractive returns for investors, with average annual returns of around 10% per year in the Investor's investment period.

- US real estate demonstrates, over many years, long-term appreciation in value that is sometimes not found in other countries' investment opportunities. The US market provides opportunities to generate capital gains over the investors’ holding investment period.

- Returns can vary depending on the property type and location, but there are opportunities to generate high returns in many primary and secondary markets.

- Commercial real estate is a relatively inflation-proof investment, meaning that the value of properties tends to increase over time.

More on global investment

- Commercial real estate in the US is relatively liquid, meaning that it can be easily bought and sold.

- There is a large and active market for commercial real estate investment, with a wide range of Investment opportunities, including residential-single families and condominiums and commercial opportunities such as shopping centers, industrial buildings, parks, multi-family and office buildings, and hotels.

- Foreign investors can also access financing to purchase commercial real estate in the US.

- Investing in commercial real estate in the US can help foreign investors to diversify their portfolios and reduce their risk.

- The US economy is relatively insulated from global economic shocks, making it a good haven for foreign investment.

- Commercial real estate is also a relatively uncorrelated asset class, meaning its performance is not closely correlated with other asset classes such as stocks and bonds.

- The US tax regime for commercial real estate is generally favorable for investors.

- Investors can deduct depreciation expenses from their taxable income, significantly reducing their current year’s tax liability.

- There are also several tax breaks available to investors who invest in certain types of commercial real estate, such as affordable housing and historic preservation projects.

Overall, the US commercial real estate market offers many attractive features for foreign investors, including solid economic fundamentals, attractive returns, liquidity, diversification, and an attractive tax regime. The most popular property types for foreign investors are multifamily and industrial,

Foreign Investment:

- Stability and Safety: The U.S. is viewed as a political and economic haven.

- Strong Demand and Growth: The U.S. market has largely recovered from the financial crisis and is fueled by solid job creation and business expansion.

- Attractive Returns: U.S. commercial real estate offers the potential for higher returns relative to the modest prime capitalization rates in other markets like London and parts of Asia.

- Scale and Liquidity: The U.S. market is renowned for its scale and liquidity, allowing foreign investors to exit their investments if they decide to invest their capital elsewhere.

- Income Growth Optimism: Increasing optimism around income growth and the asset class’s stable yields has seemingly outweighed broader economic and business concerns.

- Opportunity for Cash Flow Generation: The United States provides the perfect opportunity for real estate investors to generate cash flow through rental income, capital appreciation, and profits from commercial activities that rely on investment properties.

- Prestigious Locations: The US has many prestigious universities, state colleges, educational institutions, and fascinating lifestyle locations like San Diego, CA. The Investor will find investment opportunities to invest in real estate near educational institutions in every lifestyle community.

Foreign investment in U.S. real estate saw an uptick in the second half of 2021 as limitations on travel were lifted with the vaccine rollout, and optimism around new patterns for growth bloomed.

MAIN, a real estate firm combining its institutional corporate investment capacity with complete personal real estate services, is pleased to offer its Investment and Management Services to Foreign Investors who reside domestically throughout the world (Foreign Global Investor) who desire to make US real estate Investment(s), specifically in California in Income and Appreciation (Growth) Properties.

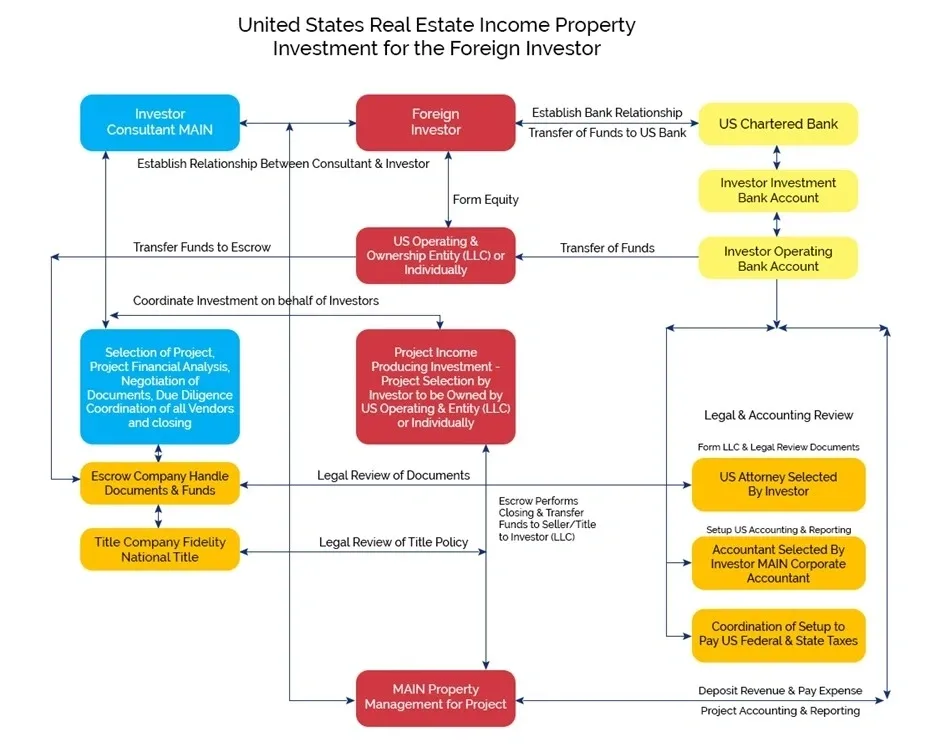

MAIN will research, locate, and negotiate the Purchase and management of income properties. MAIN will use best efforts to meet your investment requirements, assist foreign investor(s) to meet US tax filing obligations, manage and provide property accounting and reporting, and forward all profits to the Investor's US bank account - after the payment of all US Federal and State taxes. Enclosed is a diagram of all the steps required to own real Property in the US.

Theodore N. Deuel, Financial Engineer, MBA, CCIM, CIPS, Director, is pleased to assist Foreign Global investors, including Mexico and Canada, who desire to explore the purchase and property and asset management of US real estate assets. Theodore Deuel can be reached by e-mail at [email protected].

Foreign Owners of

US Rental Property

All foreign investors owning US rental property are responsible for paying taxes on all rental income earned in the US, regardless of any tax treaties that may exist. The Investor can either pay a flat tax of 30 % of their gross rental income or elect to file an annual US tax return and reduce their taxes by claiming deductions relating to ownership and management of the Property. (i.e., Property Taxes, Insurance, Management Costs, etc.). With either method of taxation, each Investor must have an Individual Taxpayer Identification Number (ITIN). The IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for Social Security Numbers (SSNs).

Obtaining A Taxpayer ID

As soon as possible, the Investor needs to obtain a US Individual Taxpayer Identification Number (ITIN) as Owner of the Property (Each person listed on the property deed). The application is made with IRS Form W-7, and the Investor must provide original certified identification documents.

What documents are needed to apply for an ITIN?

Below is the list of the only acceptable documents:

The IRS has 'Certified Acceptance Agents' who are authorized to certify your original documents and process the application. The W-7 form may look easy, and you may want to process it yourself but save yourself, time by employing an agent. Certified Acceptance Agents are located worldwide. Contact an agent in your country of residence. It normally takes 4-6 weeks for your W-7 to be processed by the IRS.

Upon receiving your ITIN number from the IRS, you must provide MAIN with a copy of the IRS letter showing your new Individual Taxpayer Identification Number (ITIN). MAIN will not manage rental Property for foreign owners who do not acquire an ITIN number and/or a corporate EIN number.

Obtaining a

US Chartered Bank Account(s)

To obtain a bank account in the US for Investment purposes, the investor must have an ITIN number. MAIN will assist the Investor to set up a US Bank account.

The IRS has updated procedures that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes identified below before requesting an ITIN: All paragraphs located below, including Certification Process Changes (2016), TIN Certified Acceptance Agents, and click below to see our Certified Acceptance Agents for your Area.

CAAs can now authenticate the passport and birth certificate for dependents. CAAs will continue to certify identification documents for the primary and secondary applicants. Form W-7 (COA), Certificate of Accuracy for IRS Individual Identification Taxpayer Number, must be attached to each Form W-7 application submitted as verification they have reviewed the original documentation or certified copies from the agency that issued them. CAAs will have to attach and send copies of all documentation reviewed with the Form W-7 COA to the IRS.

As a reminder, AAs and CAAs must conduct an in-person interview with each applicant (primary, secondary, and dependent) in order to complete the application. Video conferencing (i.e., SKYPE) can be used if the CAA has the original identification documents or certified copies from the agency that issued them in their possession during the interview.

ITIN Certified Acceptance Agents

Deloitte and Touche, LLP

Ernst & Young LLP

KPMG LLP

PricewaterhouseCoopers LLP

BDO

Actus Tax Corporation

7th Floor Akasaka Chuo Bldg

3-2-6 Akasaka Minato-Ku, Tokyo

107-0052 Japan

81-332248880

Deloitte Tohmatsu Tax Co.

Shin Tokyo Bldg. 5F

3-3-1 Marunouchi Chiyoda-Ku, Tokyo

100-8305 Japan

81 36-213-3800

Ernst & Young Tax Co.

Kasumigaseki Building 32F

3-2-5 Kasumigaseki, Chiyoda-Ku, Tokyo

100-6032 Japan

81 33 506-2017

Noriko Nagasawa

d/b/a Nagasawa Tax and Consulting Office

1-17-8 Uchikanda Chiyoda-Ku Tokyo

101-0047 Japan

(8133) 2198211

Masaaki Chida

d/b/a Chida International Tax & Accounting

5-1-18-1101 Miyahara Yodogawa-Ku, Osaka-SHI

532-0003 Japan

81-66-350-7100

Eos Accountants LLP

Marunouchi Trust Tower- Main 20 Floor

1-8-3 Marunouchi

Chiyoda Ku, Tokyo

100-00005 Japan

81-3-5288-5241

Ernst & Young Tax Services Ltd.

22nd Floor, Citic Tower

1 Tim Mie Avenue

Central, Hong Kong

China

(852) 2846-9888

KPMG

8F Princes Building

Central, Hong Kong

China

(852) 3927-5572

Philip K. Yeung

d/b/a Yes

Unit 1203 12F CEO Tower

Cheung Sha Wan, Hong Kong

China

(852) 3422-3923

East Asia Sentinel Tax Services Limited

22/F, Tai Yau Building

181 Johnston Road

Wanchai, Hong Kong

China

(852) 2810-1018

American Expat Tax Services Private Ltd.

545 Orchard Road

Singapore 238882

Singapore

(658) 338-1040

Hayden T. Joseph CPA LLP

d/b/a Advanced American Tax

#25-00, Samsung Hub

3 Church Street

Singapore 049483

Singapore

(659) 720-1040

Tax and Accounting Hub Ltd.

9 Temasek Boulevard

Suntec Tower 2 No. 09-00

Singapore 038989

Singapore

(656) 407-1594

Purchasing Property in the US Requires

Investors to Have Proof of Funds in US Bank

Investors are required to deposit all the necessary investment funds in the US Bank before offering to purchase Property in the US. The Seller of Investment property will require the Investor(s) to verify (by bank verification) that the Investor(s) has the required amount of funds in the US Bank to purchase the Investment property.

Investor(s) will need to decide what type of entity structure to hold the Investment Property. The Entity could be either an Individual or a California Limited Company (LLC). The Investor's legal counsel or Certified Public Accountant (CPA) will need to assist the Investor in the selection of the best entity to hold Property for the Investor.

MAIN will research the property investment market both (on-market and off-market) for those properties that meet the Investment requirements (investment holding period, yield, and risk requirements) within budgetary restraints of investment funds available. The Investor will then select the Property (s) for purchase consideration.

MAIN will negotiate with Seller the purchase price, terms, conditions of sale, and Due Diligence Period. This will be accomplished by a written non-binding Letter of Intent (LOI), which will be negotiated into a binding Purchase Agreement including a non-refundable deposit(s). The Purchase Agreement will have a contingency time (usually 60 to 90 days) to allow the Investor to review (Due Diligence Period) all the property and financial information on a non-risk basis. MAIN will coordinate and assist the Buyer with the property financial analysis and coordinate the review by the Buyer's legal counsel of all property documentation for the Buyer's decision to either (1) proceed with the Purchase or (2) reject the Purchase at the end of the Due Diligence Period. In the event the Buyer elects not to move forward with the purchase, the escrow (defined below) will be terminated (with any escrow costs, if any, shared between Buyer and Seller), and the purchase agreement will be terminated. Upon Buyer's desire to proceed with the Purchase, the earnest money escrow deposit becomes non-refundable - in the event Buyer does proceed with the property sale pursuant to the terms and conditions of the Purchase Agreement. The purchase closing (transfer of the Property to the Buyer) will usually occur within 30 to 60 days after the end of the Due Diligence Period. The total contractual period for the Purchase, through due diligence and closing, is usually between 90 and 120 days.

What is escrow? Escrow is the process whereby parties to the transfer or financing of real estate deposit documents, funds, or other things of value with a neutral bonded and disinterested third party (the escrow main or holder), these assets are held in trust until a specific event or condition takes place (as set forth in the purchase agreement) and or according to specific, mutual written instructions from the parties. Escrow is essentially a clearinghouse for the receipt, exchange, and distribution of the items needed to transfer or finance real estate. When the event occurs, or the condition is satisfied, distribution and transfer take place. When all the elements necessary to consummate the real estate transaction have occurred, the escrow is "closed."

See http://www.dre.ca.gov/files/pdf/escrow_info_consumers.pdf for a full explanation of escrow.

The Escrow company will handle all the property documents and funds between the Buyer and Seller, pursuant to all the terms and conditions of the Purchase Agreement and escrow instructions prepared by the escrow company, agreed to by and between the Buyer and Seller. All funds for Purchase received from both Buyer and Seller are deposited with the escrow holder or company to be transferred to Seller and Buyer according to the escrow instructions. The Buyer's legal counsel will review all the escrow documents, including the legally recorded status of the title to be conveyed to the Buyer. Once all the escrow instructions are adhered to by both Seller and Buyer, the escrow will legally transfer the Property to Buyer by Grant Deed, recorded in the County where the Property is located.

A title company ensures that the title to a piece of real estate is legitimate and then issues title insurance for that Property. The title company makes sure a property title is legitimate, so that the Buyer may be confident that once the Buyer buys a property, the Buyer is the rightful Owner of the Property. To ensure that the title is valid, the title company will do a title search, which is a thorough examination of property records to make sure that the person or company claiming to own the Property does, in fact, legally own the Property and that no one else could claim full or partial ownership of the Property. Title insurance protects the lender and/or Owner against lawsuits or claims against the Property that result from disputes over the title. Title companies may also serve as the escrow company to ensure that funds in escrow are used only for settlement and closing costs and may conduct the formal closing on a property. At the closing, a settlement main from the title company will prepare all the necessary documentation, explain it to the parties, collect closing costs, and distribute monies. Finally, the title company will ensure that the new titles, deeds, and other documents are filed with the appropriate entities.

MAIN's Management of the Property

MAIN will enter into a Property Management Agreement with the Investors' entity (Client) to provide all the requested services required by Client; including but not limited to collection of all rents; deposit of all revenue; payment of all expenses; providing all required property maintenance and insurance; establish all operating budgets for approval of Client; "online" project accounting and reporting and the coordination of filing the annual Federal and State tax returns prepared by the Client's CPA, at Client's sole cost. See all available services herein on this Web site.

IRS Form W-8ECI

The Internal Revenue Service (IRS) requires MAIN, the property manager, to withhold 30% of the gross rent to ensure the Investor will file a tax return at year-end. This is obviously very costly to the Investor. However, there is an alternative that will exempt the Investor from the mandatory 30% withholding. After obtaining an Individual Taxpayer Identification Number (ITIN), the Investor must submit to MAIN Form W-BECI. If the Investor does not file a form W-8ECI with MAIN, we are REQUIRED by law to withhold 30% of the income from the rental and forward the funds to the IRS. Note: MAIN will not manage properties for owners who do not file the W-BECI form with MAIN.

By filing Form W-BECI, the Investor eliminates the mandatory 30% tax withholding as it notifies the property manager (and the IRS) the Investor will be filing annual tax returns to fully report the income and expenses related to the rental Property. Most generally, the Investor will file Form 1040NR (Non-Resident Tax Return) with the IRS. Tax returns are due each year, and the Investor should consult with a tax professional.

Form 1042-S

At the end of each year, MAIN will provide the Investor with a year-end statement of income and expenses related to the management of the Property. Along with the year-end statement, the Investor will receive a copy of IRS Form 1042-S that reports the income to the IRS. The Investor will then use this copy of Form 1042-S to file taxes through a tax professional.

Legal Disclaimer: The material provided here is for informational purposes only and is not intended and should not be considered legal advice for investors. Please contact your attorney and/or tax professional to obtain advice with respect to any issue or problem. Applicability of the tax or legal principles discussed in this material may differ substantially in individual situations.